Lesotho’s government wanted to be more proficient at recording and managing debt. So it did what increasing numbers of governments are doing – it consulted our experts. In the spring of 2017, Lesotho seconded two debt officers to work with our team in London.

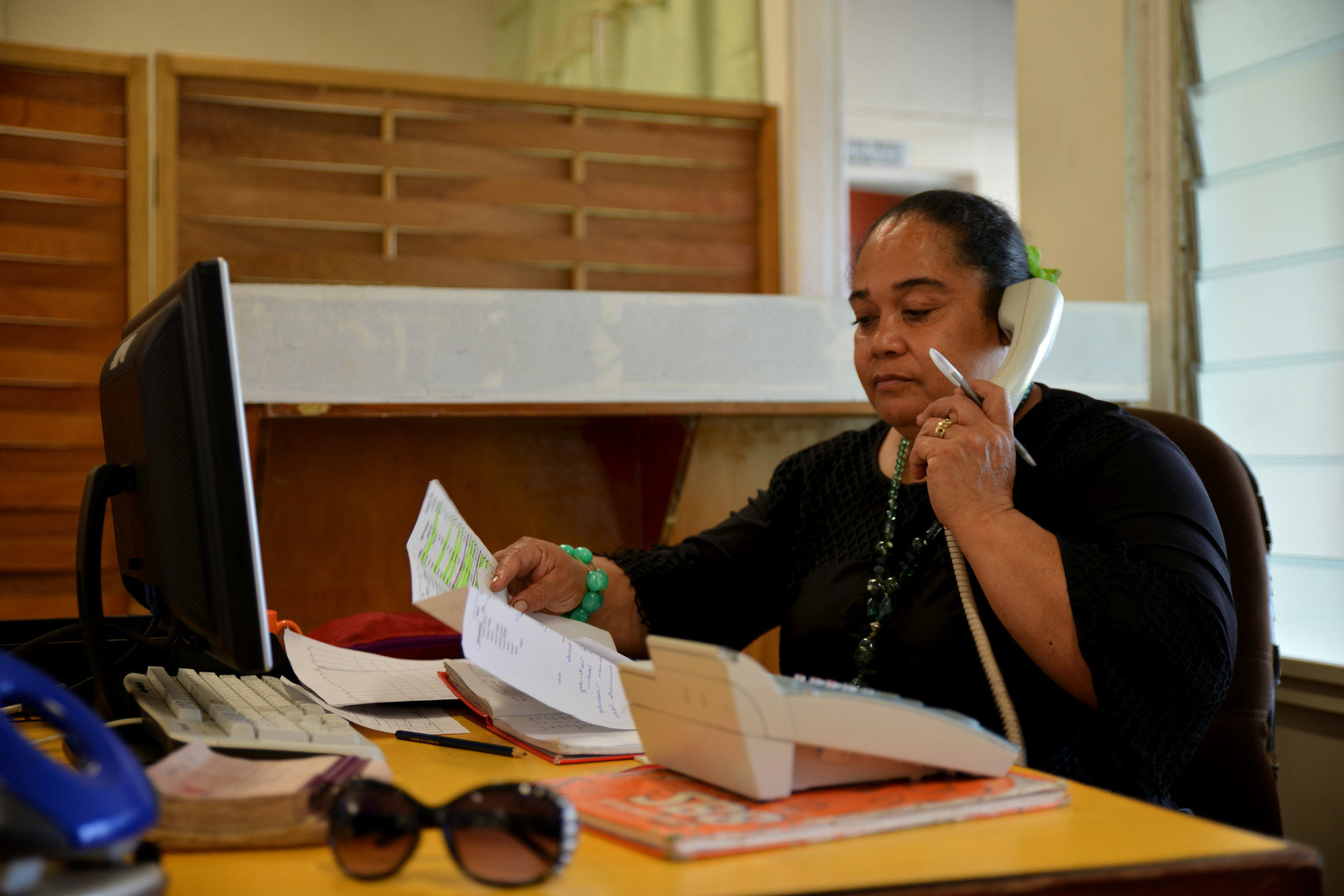

Ms Keletso Matsela and Ms Mapoloko Seitlheko spent two weeks with the Debt Management Unit (DMU). Drawing from its expertise, they learned how to interpret new complex loan agreements. They also deepened their knowledge of the Commonwealth Secretariat’s Debt Recording and Management System (CS-DRMS). The software is used by more than 100 agencies including ministries of finance, treasuries and central banks in 60 countries.

The Government of Lesotho has been using CS-DRMS since 1994 at its Ministry of Finance and Planning. The system helps it record and manage its public and publicly guaranteed external and domestic debt portfolio. Recently, the government started to use the system to record grants. The software therefore plays a critical role in helping the government to achieve its public finance management objectives.

The small southern African kingdom has asked our DMU for additional assistance to review the quality of Lesotho’s debt database. It has also expressed an interest in embedding expertise within the government. This way it can ensure its debt recording and management continue to be effective.

The 2015-2017 period has been particularly successful for the Secretariat’s debt management programme. We continued to provide policy advice, helping member countries strengthen public debt management in line with international best practices.

The Caribbean gave us cause for concern though. A report, Achieving a Resilient Future for Small States: Caribbean 2050, warned that, on its current development path, the Caribbean in 2050 will face unmanageable debt.

trained by the Commonwealth

Here are the highlights of 2015-2017 from our DMU:

- We have been developing Meridian, our debt management system, which will replace CS-DRMS. It will be piloted in 2018.

- The total number of member countries using the existing CS-DRMS system has risen to 44.

- Cyprus and the Revolutionary Government of Zanzibar adopted CS-DRMS.

- The Central Bank of The Bahamas is setting up a central securities depository (CSD).

- Fiji implemented our recommendations in reopening its infrastructure bonds – a critical first step towards developing market liquidity as it facilitates consolidation of government securities and creates larger stocks of bonds. This will boost trading, and should ultimately lead to lower borrowing costs for the government and lower taxes for Fiji’s citizens.

- We rolled out our new e-learning tool across Africa, Asia, the Caribbean, Europe, and the Pacific. A total of 164 debt managers are now trained in domestic and external debt management, and debt recording in CS-DRMS.

- Barbados, Guyana and Lesotho benefitted from short-term attachments at the offices of the Secretariat.

- We published Risk Management of Contingent Liabilities and Public Debt – a new, practical publication on quantifying the risk of contingent liabilities.

In addition, the following countries accepted our recommendations:

- Malta agreed to strengthen its policy frameworks. Our advice will help it provide an effective legal framework to support sound practice, good governance and prudent principles for debt management. The proposed changes were enacted by the Parliament of Malta in July 2017.

- Trinidad and Tobago implemented recommended reforms to reorganise their debt office to facilitate specialisation and improve risk management processes.

- Fiji, Sri Lanka and The Bahamas accepted and began to implement recommendations relating to their bond market development.

- Fiji, Jamaica and Mauritius adopted the Horizon public debt analytical tool.

Now we look forward to reporting that Lesotho is also benefitting from the expertise we shared with Ms Keletso Matsela and Ms Mapoloko Seitlheko.

“The Commonwealth’s real force is as a unique all-purpose network, whose embrace includes trade, education and an array of 180-odd professional bodies, from law to dentistry.” – Economist, March 2016